food sales tax in pa

Generally the sale of food and beverages including candy and gum by a food retailer or a nonfood retailer is not subject to tax. Click here to download the states sales tax guide For example pet food is subject to sales tax while flea and tick shampoo for pets is.

States With Highest And Lowest Sales Tax Rates

The service charge which is not in lieu of the gratuity is taxable.

. While the Pennsylvania sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. This includes food sold by an establishment selling ready-to-eat food for consumption on or off the premises on a take-out or to-go basis or delivered to the purchaser. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Pennsylvania sales tax Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 8.

Statutory or regulatory changes judicial decisions or different facts may modify or negate the tax determinations as indicated. The filing process requires businesses to detail total sales in the state the amount of sales tax collected and the location of each sale. The following is what you will need to use TeleFile for salesuse tax.

The Pennsylvania sales tax rate is 6 percent. Of those thirty-two states and the District of Columbia exempt groceries from the sales tax base. Food not ready-to-eat candies and gum most apparel textbooks computer services prescription pharmaceuticals sales for resale and household heating fuels such as oil electricity natural gas coal and firewood are among the major commodities excluded from the tax.

There are two options for filing a Pennsylvania sales tax return. To learn more see a full list of taxable and tax-exempt items in Pennsylvania. Major items exempt from the tax include food not ready-to-eat.

Nine-digit Federal Employer Identification Number or Social Security number or your 10-digit Revenue ID. Construction Contractors Guide for Building Machinery and Equipment. Sales Tax Groceries information registration support.

Here are the special category rates for Pennsylvania. By law sales from eating establishments located in Allegheny County and Philadelphia County are subject to an additional sales tax rate of 1 and 2 respectively. Municipal governments in Pennsylvania are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 0166 for a total of 6166 when combined with the state sales tax.

The Pennsylvania sales tax rate is 6 percent. 31 rows Pennsylvania PA Sales Tax Rates by City Pennsylvania PA Sales. See chart on Page 25.

Meals and prepared foods are generally taxable in Pennsylvania. The Pennsylvania sales tax rate is 6 percent. In the state of Pennsylvania sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

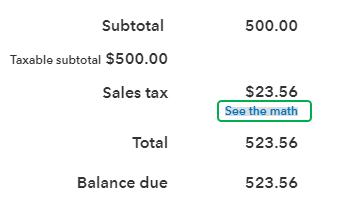

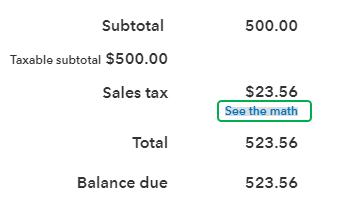

Philadelphia PA 8 sales tax in Philadelphia County 21200 for a 20000 purchase Reading PA 6 sales tax in Berks County You can use our Pennsylvania sales tax calculator to determine the applicable sales tax for any location in Pennsylvania by entering the zip code in which the purchase takes place. Pennsylvania is one of the few states with a single statewide sales tax which businesses are required to file and remit electronically. Pennsylvania has a statewide sales tax rate of 6 which has been in place since 1953.

This page describes the taxability of food and meals in Pennsylvania including catering and grocery food. Whether the customer is dining in or taking out. Farming REV-1729 Mushroom Farming.

To verify your Entity Identification Number contact the e-Business Center at 717-783-6277. While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. File online with PADirectFile.

Medical and Surgical Supplies. The Pennsylvania PA state sales tax rate is currently 6. Forty-five states and the District of Columbia levy a state sales tax.

Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and medicines. The following are the food sales tax rates as well as general sales tax rates in these states. Since books are taxable in the state of Pennsylvania Mary charges her customers a flat-rate sales tax of 6 on all sales.

5 Sale of food and beverages by food retailers and nonfood retailers. Food 8person 400 Room 100 Liquor 60 Floral Decorations 75 50 Settings 2setting 100 5 Waiters 25 125 1 Bartender 35 35 5 tables 5 25 50 chairs 250 125 Service charge 100 Gratuity 172 ------ SUBTOTAL 1317 Sales Tax 6510 --------- TOTAL 138210. Ad Get Pennsylvania Tax Rate By Zip.

I Schools and churches. By Jennifer Dunn August 24 2020. Eight-digit Sales Tax Account ID Number.

Generally tax is imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the purchaser or consumer when purchased from a caterer or an eating establishment from which ready-to-eat foods and beverages are sold such as a restaurant cafe lunch counter private or social club. Clothing EXEMPT Groceries EXEMPT Prepared Food Prescription Drugs EXEMPT OTC Drugs EXEMPT. Free Unlimited Searches Try Now.

Sales tax in Pennsylvania is set at a flat rate of 6 percent. On taxable sales originating in a city or county that has imposed a local tax a separate 1 or 2 percent local Sales and Use Tax is imposed. In other words theres no better time for a map looking at how different state sales taxes treat consumable goods like candy groceries and soda.

This includes Pennsylvanias state sales tax rate of 6 Blair countys sales tax rate of 0 and Marys local district tax rate of 0. Ad New State Sales Tax Registration. Some examples of items that exempt from Pennsylvania sales tax are food not ready to eat food most types of clothing textbooks gum candy heating fuels intended for residential property or.

Returnable containers are not subject to tax. The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634. The 6 percent state Sales Tax is to be collected on every separate taxable sale in accordance with the tax table on Page 25.

Depending on local municipalities the total tax rate can be as high as 8. The amount of 1085 therefore is subject to tax. And residential heating fuels such as oil electricity gas coal and firewood.

Restaurant meals may also have a special sales tax rate.

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Pennsylvania Sales Tax Small Business Guide Truic

How Do State And Local Sales Taxes Work Tax Policy Center

How To Charge Your Customers The Correct Sales Tax Rates

2020 Sales Tax Holiday Plastic Drop Cloth Hurricane Supplies Disaster Prep

Is Food Taxable In Pennsylvania Taxjar

Businesses Required To Have Sales Tax Licenses In Pennsylvania Legalzoom Com

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

How Do State And Local Sales Taxes Work Tax Policy Center

Is Food Taxable In Pennsylvania Taxjar

Pin By Wendy Long On Dude Ctso Frosted Flakes Cereal Box Cereal Box Food

Local Peeps We Just Were Invited From Park City Diner Lancaster Knight Day Diner Lititz To Take Part In Their S O S Sharin Supportive Park City Sos

Pa Unemployment Base Year Chart Sales Taxes In The United States 350 275 Of Best Of Pa Unempl Tax Sales Tax Chart

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation